As cases of the novel coronavirus skyrocket around the world and the United States surpasses China as the nation with the most recorded cases, Americans are also fearful about the approach of April 1 when rent and mortgage payments are due.

On Wednesday, Governor Gavin Newsom announced that he had reached an agreement with several major banks to provide mortgage relief for Californians in a statement which variously referred to the relief as a “90-day grace period” and “forbearance.” As part of this relief package, borrowers will be eligible for deferment of their monthly payments, won’t have to worry about foreclosure sales or evictions for 60 days, and will have relief from fees, and negative reports to credit bureaus for 90 days.

Newsom said, via Twitter, “Millions of California families will be able to take a sigh of relief.” But the homeowners I spoke to were not exactly relieved. Barbara Maynard, a labor consultant and single mother of a teenage daughter living in Los Angeles said she reached out to her mortgage lender, Union Bank, late last week, and asked if there would be relief offered to California borrowers similar to what New York Governor Andrew Cuomo had announced. “They told me, no, we’re not going to do that. No extensions or forgiveness programs. They were very cold about it.”

After Newsom’s announcement on Wednesday, Maynard called again. This time she was told that they would give her 90 days relief from making payments without late fees and other negative consequences, but that at the end of the 90 days the full balance owed would be due. Union Bank did not return my call asking for clarification.

“It’s no help at all,” an Altadena homeowner told me. She and her husband have good jobs and are able to work from home, but the coronavirus pandemic is effecting them, too. Speaking on condition of anonymity she told me the they never quite recovered from the housing crash and recession of 2008. Their mortgage servicer, Wells Fargo, told them that any payments they missed during the 90-day deferral period would be due in full at the end of the 90-days.

I reached out to all the banks mentioned in Newsom’s press release, and some that weren’t, to get some clarity about what exactly will happen to missed mortgage payments.

Bill Halldin, a spokesperson for Bank of America, told me that for the mortgages that Bank of America owns, “we’re going to take those mortgage payments you didn’t make, and add them to the end of your loan. No one is going to be asked to pay all at once” at the end of the deferment period. This is consistent with a press release dated March 19, which says that for mortgages and home equity loans “clients can request to defer payments, with payments added to the end of the loan.”

Other banks were less categorical about it. Keosha Burns, spokesperson for Chase said, “We are going to stay in touch over the next three months and work with our customers to make sure they’re comfortable. Our goal is to help people stay in their homes.”

A spokesperson for Wells Fargo told me that at the end of the 90-day deferment period, mortgage and home equity customers have options, including a continuation of the payment suspension, moving the missed payments to end of the loan or a modification to address longer-term financial changes that may impact their ability to keep up with their monthly payments.

The complexity of mortgage finance makes one simple answer difficult. Most loans are not owned by the bank that initiated them. Mortgages that are federally guaranteed by Fannie Mae or Freddie Mac have their own provisions for helping mortgages payers. Mortgage holders are on their own to figure out what relief is available to them.

Renters, on the other hand, have no assurances. The Governor still hasn’t addressed the needs of 17 million renters in California with rent due in less than a week. On Wednesday the Los Angeles Times reported that over one million Californians had already applied for unemployment. With relief from the federal government still weeks away, Newsom has done nothing to save tenants from homelessness.

One local tenant who wished to remain anonymous who is in danger of losing her housing is emblematic of many in the gig economy. She normally works for several non-profit arts organizations that provide free art classes to local youth but the coronavirus pandemic has resulted in the loss of all her income as these organizations have been shuttered.

Nance is another Pasadena tenant who was laid off last Fall, several months before the pandemic took hold, but now has very little chance of securing employment with most businesses closed. Her unemployment benefits ran out in January. Her social security just barely covers her rent, leaving her nothing for food and other essential needs.

A few municipalities, like Pasadena and Los Angeles, have emergency eviction moratoria in place now. For at least 60 days no one will be forcibly evicted from their apartments for non-payment of rent. But under these new measures tenants are still required to make up the back rent within six months or face eviction. With many tenants living paycheck to paycheck, and 63 percent of Americans without enough savings to cover a $500 emergency, making up months of missed rent payments will be impossible for tens of thousands of Californians.

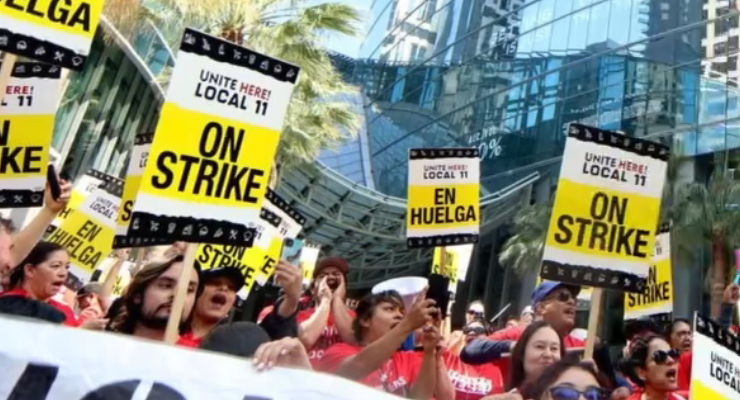

Housing justice organizations across the State of California have been asking Newsom to protect tenants from eviction and insolvency by enacting a statewide moratorium on evictions and forgiveness of rent for the duration of this crisis. On Friday, after two weeks and several state wide petitions, Gavin Newsom issued an executive order that is being called an eviction moratorium by some. But housing justice activists point out that it simply delays the inevitable.

“The Executive Order is not a moratorium on evictions,” writes the statewide housing justice orgnization, Housing NOW!, in a press release, “it is a stay of execution. It delays the inevitable, which is that millions of people will lose their homes.”

The order issued by Newsom delays eviction proceedings by 60 days but only if tenants were current on their rent prior to the pandemic, notify the landlord before rent is due or within 7 days after rent is due and have “verifiable documentation” to support their claim. Under this order the tenant is also responsible for repaying all accumulated back rent.

“We’ve never seen an economic collapse of this magnitude and it threatens to upend the lives of California’s 17 million renters, said Housing Is A Human Right Director, René Moya. “We need an eviction and foreclosure moratorium, and rent and mortgage forgiveness to prevent an unprecedented surge in homelessness and a cascading emergency for millions of families.”

While banks appear ready to modify mortgages when necessary to keep people in their homes and a few cities in California have given tenants a two month reprieve from eviction, there is currently nothing to prevent a wave of evictions from hitting California and the entire nation in coming months.

0 comments

0 comments