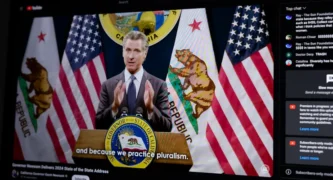

California has long had the reputation — backed by copious data — of being a high-tax state, which made Gov. Gavin Newsom’s declaration last June, in a prerecorded State of the State address, a bit startling.

“Here’s the truth Republicans never tell you: California is not a high-tax state,” Newsom said.

Later he clarified his assertion, saying California’s taxes on low-income residents are relatively lower than those in red states.

“Catering to big business and the rich is also why red states tax their lowest earners far more than California does. They punish you when you’re struggling, but give you a free pass when you’re wealthy,” the governor said.

There’s some truth to that. California’s very progressive income tax system, with the nation’s highest marginal rate of 13.3%, makes its state budget highly dependent on taxing incomes of its wealthiest residents, while those in low- and moderate-income brackets pay little or no income taxes.

Nevertheless, taxes imposed by state and local governments put California in the highest ranks of the 50 states, not only in total — more than $400 billion a year from all sources — but in per capita terms — more than $10,000 each — and as a percentage of its $3.6 trillion in total personal income.

The Washington-based Tax Foundation ranks Californians’ state and local tax burden 48th, one of the highest in the nation, out-taxed only by New York and New Jersey.

“California combines high tax rates with an uncompetitive tax structure, yielding one of the worst rankings on the Index,” the Tax Foundation says.

The state’s $322 billion 2025-26 budget counts on $297 billion from about a dozen different taxes, while cities, counties, school districts and other local agencies take in another $100 billion or so, primarily from property taxes and local shares of the sales tax.

The budget anticipates $207 billion in general fund revenues. So far revenue is running a bit ahead, but general fund spending is budgeted at $226 billion. Maneuvers to cover the gap include shifting $7.1 billion from emergency reserves, pushing the June 2026 state payroll into the following fiscal year and tapping special funds for loans.

State budget experts call it a “structural deficit” that will continue indefinitely in the absence of either sharp spending reductions or tax increases.

There’s little appetite for the former in a Legislature dominated by Democrats but some support for the latter. The California Taxpayers Association recently reported that legislators proposed more than $16 billion in new taxes and fees during the recently concluded 2025 session.

The battle over taxes appears to be headed for the 2026 ballot, with two pro-taxation measures being pushed by public employee unions and other left-leaning groups and one that would create a new hurdle for local tax increases.

One proposal, backed by the California Teachers Association, would make permanent a temporary tax increase on high-income Californians, first approved in 2012 to close a budget deficit and later extended to 2030 via a ballot measure. All of its revenue, as much as $15 billion a year, would go to K-12 schools and community colleges.

A second measure, sponsored mainly by the Service Employees International Union-United Healthcare Workers West, would impose a one-time 5% tax on the wealth of California’s billionaires, raising about $100 billion, which would be spent at the rate of $25 billion a year to cover the state’s structural deficit and prop up health care services.

The third, sponsored by the Howard Jarvis Taxpayers Association, would overturn a state Supreme Court ruling and re-impose a two-thirds voter approval requirement on all proposed local taxes designated for particular purposes.

California is a blue state with relatively high taxes now. Do voters want to add more or make it difficult to add more?

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.