Councilmember Rick Cole launched his new “City Talk” webinar series this week with a timely and provocative conversation featuring Catherine Bracy, CEO of TechEquity and author of “World Eaters: How Venture Capital Is Cannibalizing the Economy.”

Bracy, a civic technologist who has spent years researching the intersection of technology and inequality, offered a blunt thesis early in the conversation: “The shortest possible version is, it’s not the technology. It’s the capital.”

The hour-long discussion explored how the modern venture capital model is reshaping the economy — often in ways that undermine stable employment, limit pathways to homeownership, and narrow opportunities for entrepreneurs whose ideas don’t fit the high-growth “unicorn” template.

Her argument challenges the widespread assumption that technological disruption itself is responsible for social upheaval. Instead, she contends that the financial structures driving innovation deserve closer scrutiny.

Bracy explained that venture capital historically funded risky, early-stage innovation but has evolved into a system increasingly driven by the pursuit of outsized returns.

The industry selects startups according to the “power law,” meaning a tiny number of astronomical successes must compensate for the many companies that fail.

This dynamic fuels a culture of “winner takes all” competition and “breakneck growth,” which she argues can distort corporate priorities and societal outcomes.

As Bracy noted elsewhere, venture capital has become “too obsessed with raking in short-term results and rapid growth at any cost,” a pattern she says has distorted industries ranging from food delivery to housing.

During the webinar, the conversation turned to how this emphasis on speed and scale affects workers.

Research from TechEquity found the VC model can “exploit workers” and harm the broader economy, underscoring how financial incentives shape employment practices.

Rather than supporting durable companies with predictable career ladders, investors often prioritize hypergrowth — a strategy that can result in layoffs, contract work, and volatility once market expectations shift.

The discussion also addressed the connection between venture-backed tech expansion and rising housing costs — a topic with particular resonance in California.

According to TechEquity’s research, venture capital is “impacting the health of our economy by exacerbating the housing crisis.”

Bracy argues that the downstream effects are felt not only by renters but by aspiring homeowners who find themselves priced out of markets reshaped by high-salary tech growth and investor-driven development patterns.

The broader concern, she suggested, is structural: when capital chases exponential returns, it can unintentionally reinforce wealth inequality and leave communities struggling to keep pace.

Perhaps the most animated segment of the conversation centered on entrepreneurship.

“If you’re an entrepreneur with a great idea that doesn’t fit the venture model, you have two choices,” Bracy has written. “Take venture capital money and distort your business to chase growth you can’t sustain — or get no funding at all.”

That binary, she argues, discourages the creation of sustainable, community-oriented companies and channels investment toward speculative bets.

“The real problem isn’t the companies that VC funds — it’s the ones it doesn’t,” TechEquity summarizes from her research, warning that capital is siphoned away from practical solutions and into “the next speculative bubble.”

For local economies, the implications are significant: fewer small businesses built for longevity and more pressure to conform to a model designed for billion-dollar exits.

Bracy stressed that venture capital “is not a good fit for the majority of start-ups — and yet, there are too few options for early stage funding outside of VC dollars.”

Without regulatory changes or alternative financing pathways, she warned, there is little incentive for investors to move away from what she memorably described as “the roulette table that is venture capital.”

Still, Bracy struck a cautiously optimistic note, arguing that reform is possible if policymakers and communities rethink how capital flows through the innovation economy.

“We can build a startup ecosystem that rewards real value, not just speculative hype,” she has said.

Cole’s new webinar series aims to bring national thought leaders into dialogue with local audiences about the forces reshaping cities. If the inaugural session is any indication, “City Talk” will not shy away from big questions.

Bracy closed with a reminder that debates about technology often miss the deeper structural issue.

“It’s not the technology,” she reiterated in describing her research. “It’s the capital.”

For viewers, the takeaway was clear: understanding the future of cities may require looking beyond innovation itself — and following the money that determines which ideas flourish, which communities benefit, and which opportunities never get off the ground.

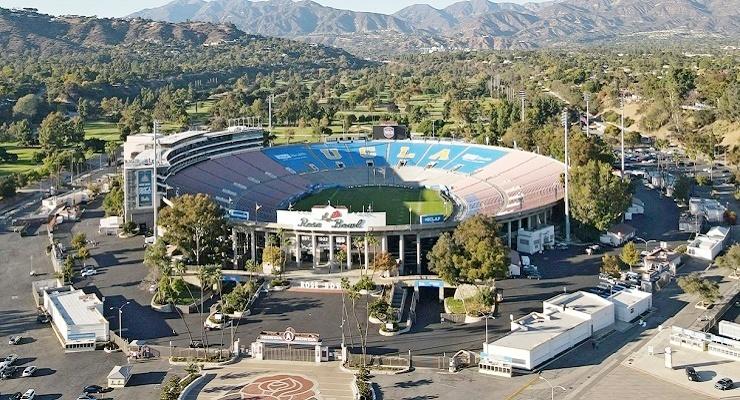

For Pasadena, those lessons are especially pointed since the city has long been a focus on tech and engineering innovation as the home to Caltech and JPL.

Building on that legacy to bolster our version of the American Dream (good jobs, home ownership and opportunities to start an independent business) will require bold and fresh approaches to avoid being crushed by the avalanche of nearly half a trillion dollars in annual global venture capital investments.

“It also underscores the timeliness of looking at how our local Fire and Police pension system invests its money,” Cole noted.