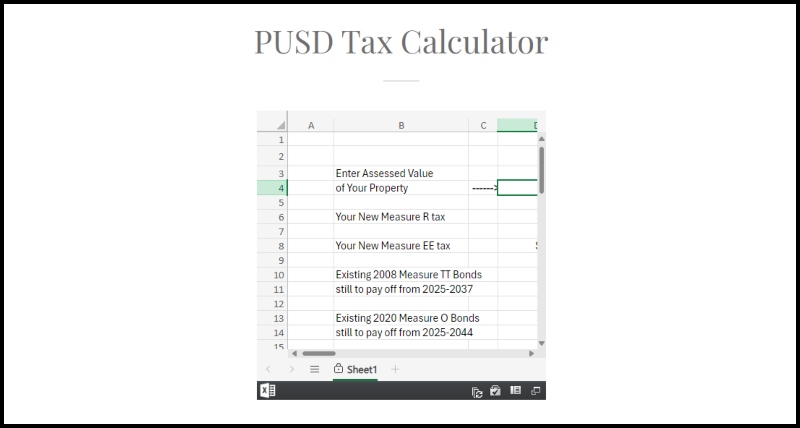

A local organization opposing two Pasadena Unified School District ballot measures has released an online calculator it claims will estimate property owners’ potential tax burden over the next three decades if the measures pass.

The group, calling itself Pasadena, Altadena and Sierra Madre Voters for School Reform 2024 – No on Measures EE and R, says the beta version of their tool allows property owners to calculate their projected PUSD tax liability if voters approve Measures EE and R on Nov. 5.

Measure EE, a parcel tax needing two-thirds voter approval, would charge $90 per parcel annually for eight years, generating approximately $5 million each year.

Measure R is a $900 million general obligation bond requiring 55% voter approval. If passed, it would levy an estimated average annual tax rate of less than $59 per $100,000 of assessed property value for various school improvements.

PUSD has previously passed bond measures, including Measure O in 2020 for $516.3 million and Measure TT in 2008 for $350 million.

Supporters argue the measures are necessary to address critical infrastructure needs in the school district.

Michael Vogler, spokesperson for the organization, said in a press release, “Property owners will already be liable for more than $1 billion in principal and interest attributable to past PUSD Bond Measures TT and O. Measures EE and R will increase this amount by another $1.6 billion in principal and interest for a total of $2.6 billion. Visit our PUSD tax calculator at www.votenooneer.com/tax-calculator to find out your share.”

The accuracy of the online tax calculator’s estimates has not been independently verified.

3 comments

3 comments