Linker Finance, headquartered in Pasadena, will provide its mobile and online banking technology to the Bank of Brodhead through Vault.Bank, the companies announced on Thursday.

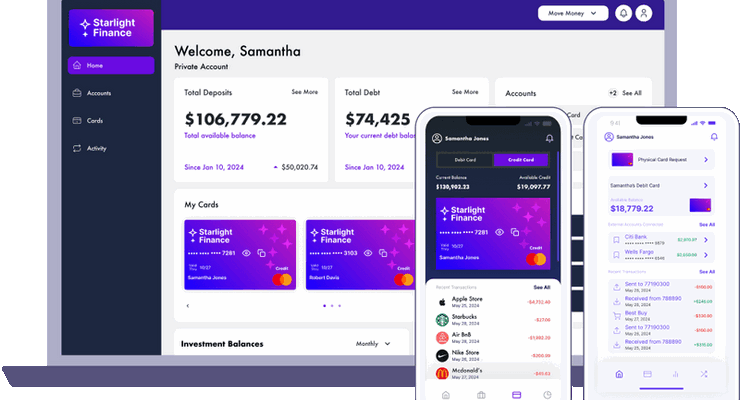

The partnership integrates Linker Finance’s real-time two-way unified API system with Fiserv Premier Core, offering features including automated verification processes, fraud detection and treasury management services.

“We’re thrilled to partner with Linker Finance to provide enhanced digital banking solutions for community banks,” said Mike Olson, President and Chief Executive of Bank of Brodhead.

Bank of Brodhead, which has operated in Wisconsin since 1896, aims to help their community grow and prosper by providing outstanding financial services that cater to needs.

“We are excited about our partnership with The Bank of Brodhead and the opportunity to support their growth across Wisconsin and beyond,” said Jorge Garcia, Linker Finance Founder and CEO.

The platform includes account opening, digital banking, payments, and tailored solutions for retail and business clients, along with over 30 integrated features for enhanced banking operations.

“Our collaboration highlights the power of a streamlined customer experience, seamless technology, and smart automation, all while preserving the human touch that makes relationship banking so successful,” Garcia said.

Vault.Bank will integrate these tools into existing operations while maintaining Linker Finance’s traditional community banking approach.

0 comments

0 comments