Los Angeles County property owners affected by current wildfires can qualify for immediate property tax relief and payment deferrals, California tax officials announced today.

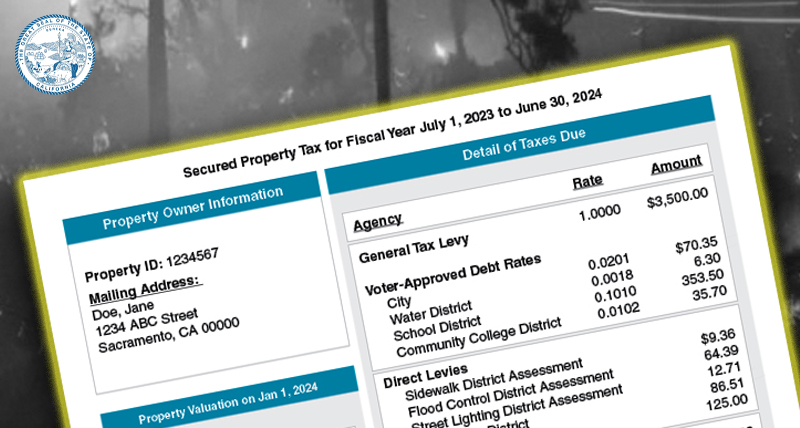

The State Board of Equalization said properties in Governor-proclaimed disaster areas or those experiencing qualifying calamities with damage of at least $10,000 of current market value can receive temporary tax reductions and potential refunds. Once properties are rebuilt, their pre-damaged values will be restored.

Affected owners must file claims with the Office of Los Angeles County Assessor Jeff Prang within 12 months of the damage date or their County’s specified timeframe, whichever is later. Eligible owners can also defer their next property tax installment without penalties or interest.

“Our hearts and prayers go out to all the residents and communities impacted by these devastating wildfires, and we thank all of the courageous firefighters and first responders who continue to battle the ongoing fires,” said State Board of Equalization Chairman Ted Gaines.

“As a resident of Los Angeles County, witnessing the devastation firsthand has been truly heartbreaking. As our communities begin the process of recovery and rebuilding, I want to emphasize that property tax disaster relief is available for those whose homes or businesses have been damaged or destroyed,” said State Board of Equalization Member Antonio Vazquez.

The State Board of Equalization’s Taxpayers’ Rights Advocate Office has published a new guide, “Information Guide for Disaster Relief for Damaged or Destroyed Property,” outlining relief options from the time of property damage through rebuilding or purchasing replacement property. Additional resources are available on the State Board of Equalization’s Disaster Relief webpage and at ca.gov/LAfires.

The California State Board of Equalization, established in 1879 and comprised of four Equalization District Members and the State Controller, is the nation’s only elected tax Board. It oversees property tax administration across 58 counties, assesses regulated railroads and certain public utilities, and manages the Private Railroad Car Tax, Alcoholic Beverage Tax, and Tax on Insurers. The State Board of Equalization’s oversight ensures uniform assessment practices that protect tax revenue supporting schools, local communities, and the State of California.

4 comments

4 comments